rhode island state tax withholding

RI Employer Account No. The Rhode Island RI state sales tax rate is currently 7.

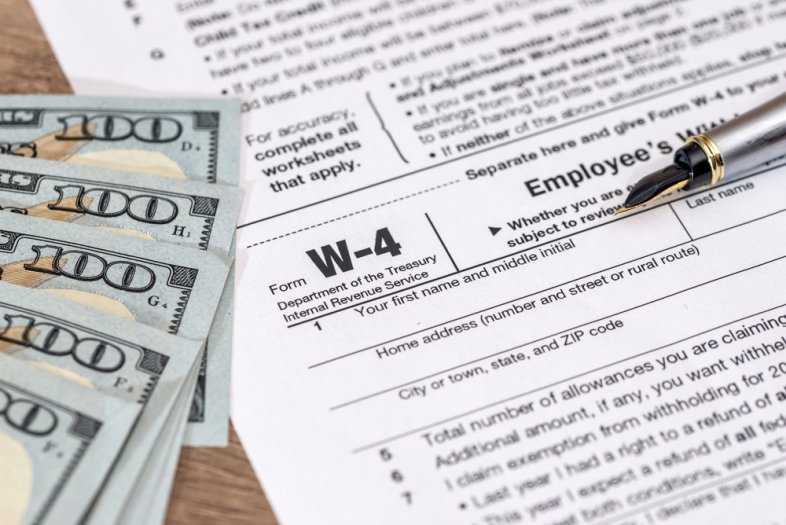

How To Fill Out A W 4 A Complete Guide Gobankingrates

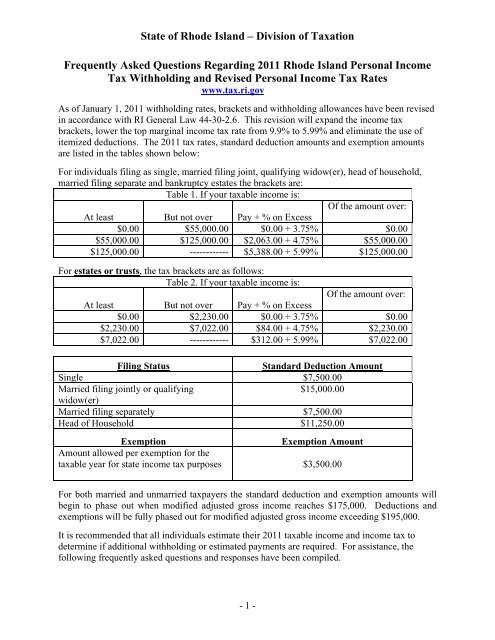

The income tax withholding for the State of Rhode Island includes the following changes.

. 10 digits include leading zeroes First. How to Calculate 2021 Rhode Island State Income Tax by Using State Income Tax Table 1. RI Department of Labor and Training Employer Tax Unit 1511 Pontiac Ave Cranston RI 02920-0942 Contact information as well as additional information regarding this.

Martha Martinez a nonresident is selling property in Rhode Island and 20 days before the closing elects the gain method of withholding by computing the RI 713 Election form and. Permit to make sales at retail Income tax withholding account including withholding for pensions. The table below shows the income tax rates in Rhode.

Free Unlimited Searches Try Now. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three children maximum. The annualized wage threshold where the annual exemption amount is eliminated has changed.

An employer may withhold Rhode Islands personal income tax at the request of the employee even though the employees wages are not subject to Federal income tax withholding. The annualized wage threshold where the annual exemption amount is eliminated. Here are the basic rules on Rhode Island state income tax withholding for employees.

Download tax rate tables by state or find rates for individual addresses. Go to the Tax Portal. The Division of Taxation has created this webpage specifically for the.

The income tax withholding for the State of Rhode Island includes the following changes. Find your income exemptions 2. The Rhode Island Division of Taxation has a new web portal httpstaxportalrigov.

Rhode Island employer means an employer maintaining an. Free Unlimited Searches Try Now. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of.

2022 Child Tax Rebates. Employers are responsible for making the required deductions from their workers earnings and forwarding all TDI withholdings to the Employer Tax Section each quarter along. If the employers average Rhode Island withholding for the previous calendar year is 200 or more per month the employer is required to file and remit the monthly withholding tax by.

RI Employer Tax Section 401-574-8700 Option 1 -. The income tax withholding for the State of Rhode Island includes the following changes. Ad Fill Sign Email RI RI W-4 More Fillable Forms Register and Subscribe Now.

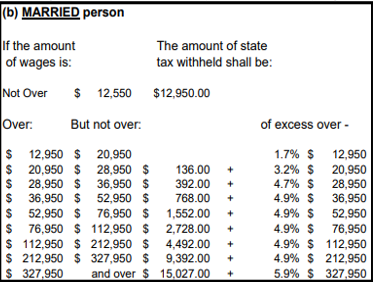

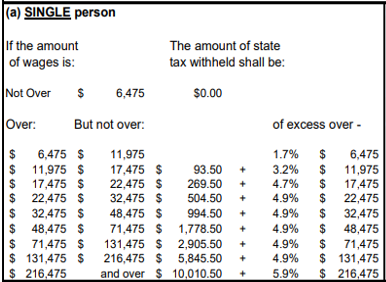

Employer Wage Tax Filing. What is Rhode Island state tax. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates.

Up to 25 cash back Monthly. Ad No Money To Pay IRS Back Tax. This application may be used to register your business for the following.

The annualized wage threshold where the annual exemption amount is. Filing for Quarter 2 of 2022 will be open from 07-01-2022 through 07-31-2022. Download tax rate tables by state or find rates for individual addresses.

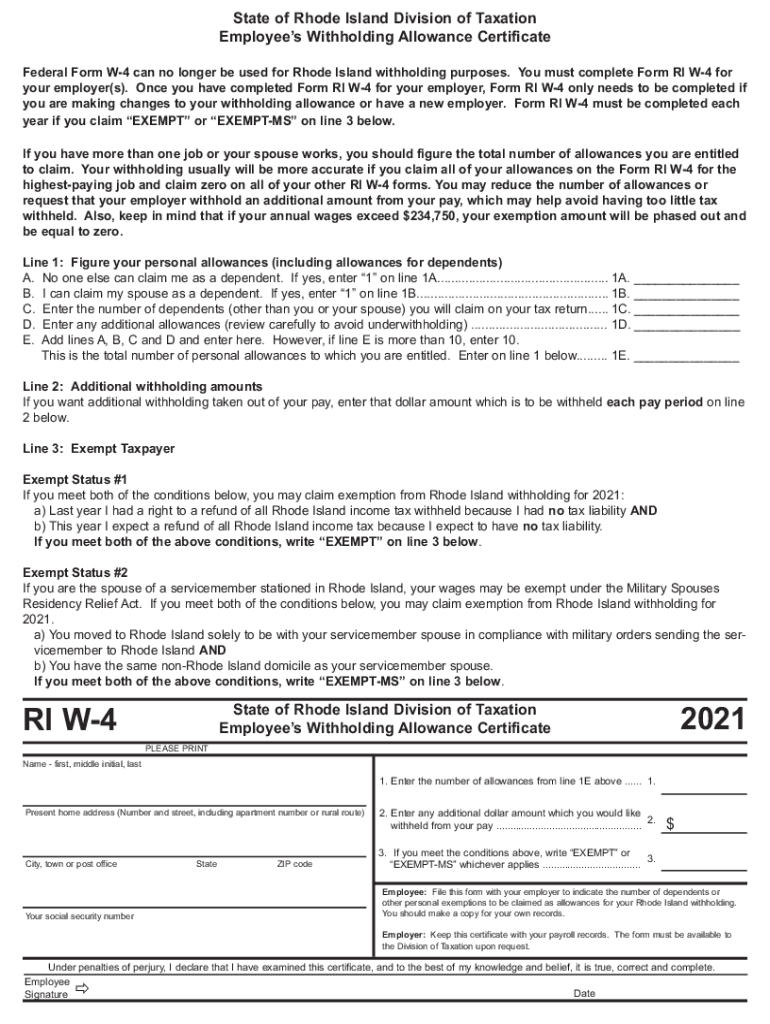

UMass employees who reside in Rhode Island use the RI-W4 form to instruct how RI state taxes should be. Effective July 11 2022 this site will be deactivated and users will no longer be able to access historical. Ad Lookup State Sales Tax Rates By Zip.

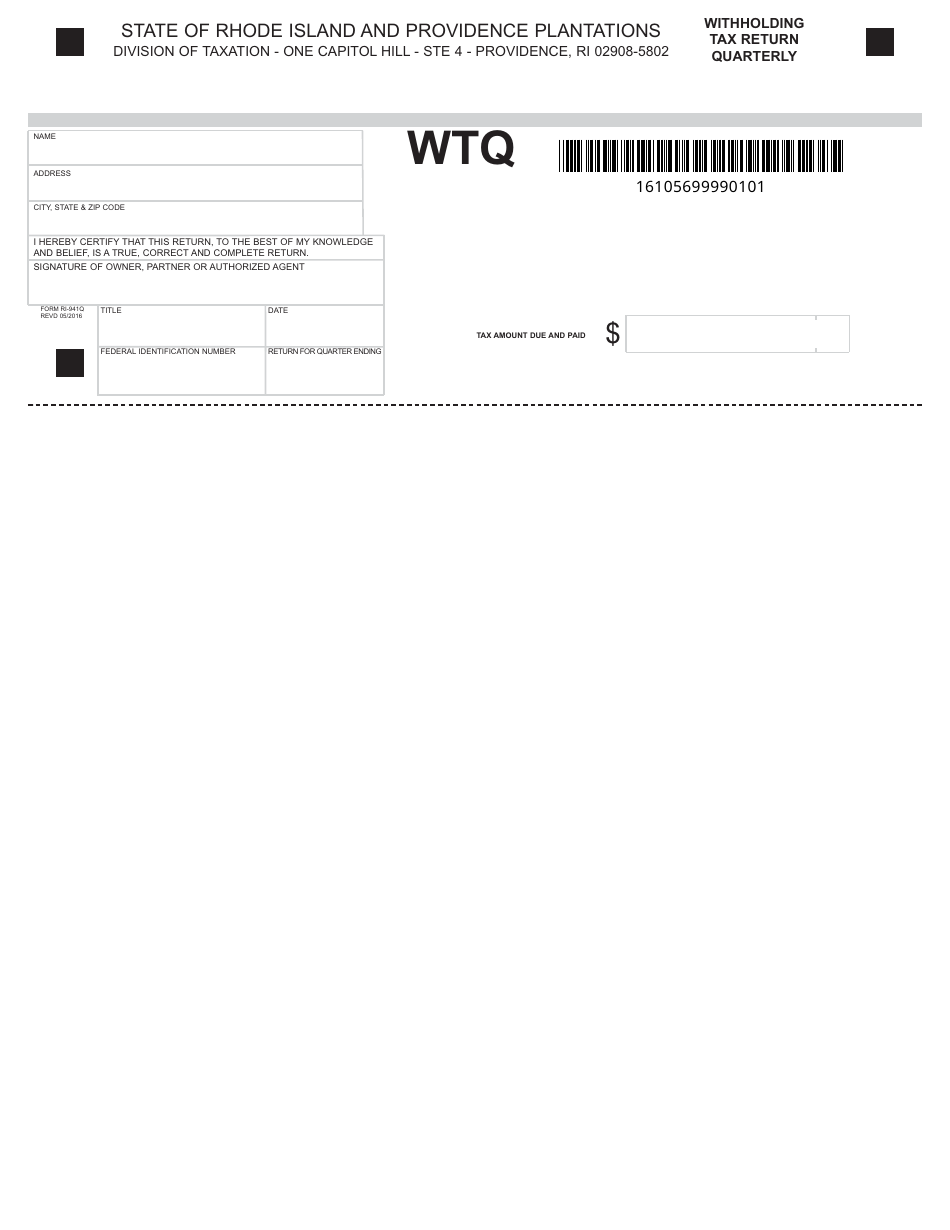

Ad Lookup State Sales Tax Rates By Zip. If your state tax witholdings are greater then the amount of income tax you owe the state of Rhode Island you will receive an income tax refund check from the government to make up. Withholding Tax Forms All forms supplied by the Division of Taxation are in Adobe Acrobat PDF format To have forms mailed to you please call 4015748970 Withholding tax forms.

RI Division of Taxation Registration Section 401-574-8829 - withholding and sales tax registration only questions. Tax Portal The RI Division of Taxation Self-Service Taxpayer Portal The new and improved way to file and pay your business and personal taxes online. Find your pretax deductions including 401K flexible account.

Rhode Island Income Tax Withholding Certificate RI-W4 RI W-4 2022pdf. The States FY23 budget provides for a Child Tax Rebate to eligible Rhode Island families. Generally Rhode Island withholding is required to be withheld from the wages of an employee by a Rhode Island employer.

Payments are due by the 20th day of the month following the month in which the tax was withheld for the eight months not at the end of calendar quarters.

Form Wtq Download Fillable Pdf Or Fill Online Withholding Tax Return Quarterly Rhode Island Templateroller

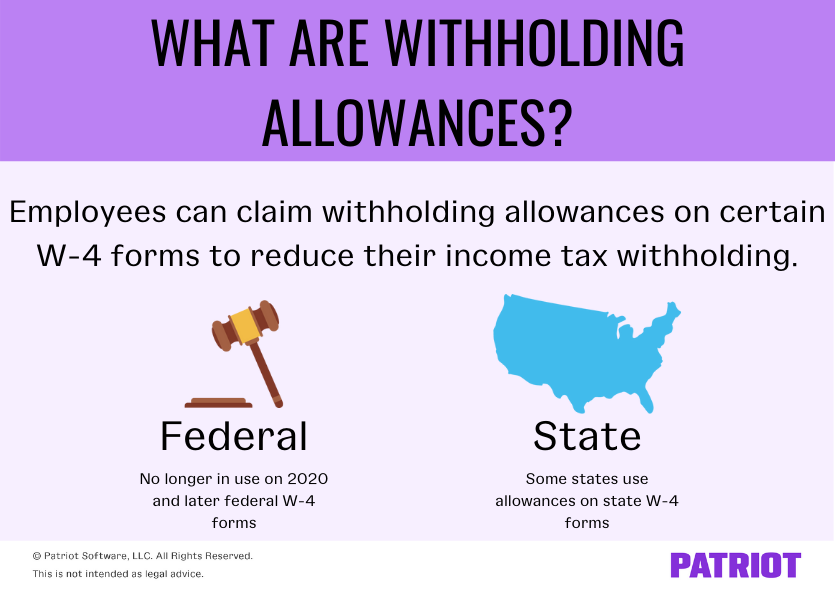

Withholding Allowances Payroll Exemptions And More

State Of Rhode Island Rhode Island Division Of Taxation Ri Gov

State Income Tax Withholding Considerations A Better Way To Blog Paymaster

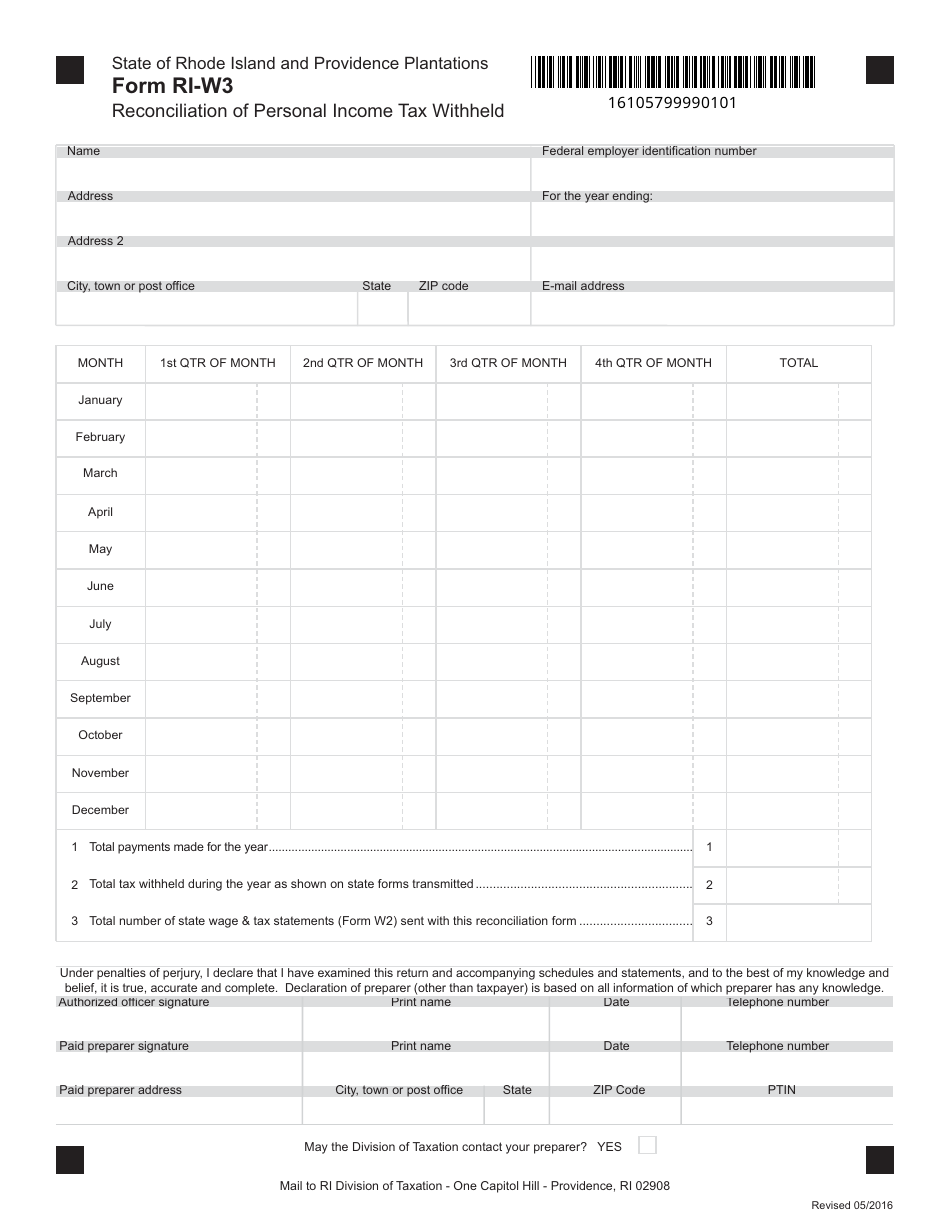

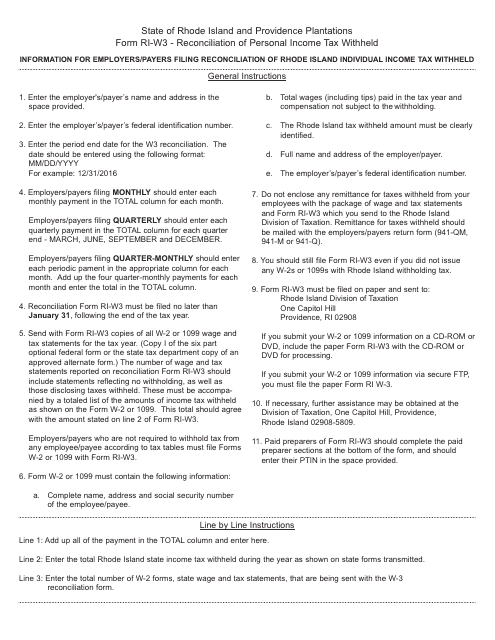

Form Ri W3 Download Fillable Pdf Or Fill Online Reconciliation Of Personal Income Tax Withheld Rhode Island Templateroller

New W 4 Irs Tax Form How It Affects You Mybanktracker

State W 4 Form Detailed Withholding Forms By State Chart

2022 Federal State Payroll Tax Rates For Employers

Ri Ri W 4 2021 2022 Fill And Sign Printable Template Online

Understanding Tax Withholding For Remote Employees A Complete Guide Cic Plus

State W 4 Form Detailed Withholding Forms By State Chart

Download Instructions For Form Ri W3 Reconciliation Of Rhode Island Individual Income Tax Withheld Pdf Templateroller

Form It 2104 New York State Tax Withholding South Colonie

Pay Envelope Hoosac Mills New Bedford Massachusetts 1941 New Bedford Massachusetts Fairhaven

Tax Withholding For Pensions And Social Security Sensible Money

How To Adjust Your Tax Withholding For A Larger Paycheck Mybanktracker

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age